Invest In The Stock Market To Start Earning Money

In the quest for long-term financial success, smart strategies are your trusty allies in the world of stock investments. These strategies can also offer a steady stream of annual income.

The stock markets in the USA, Europe, Japan, and England have consistently proven to be the gold mines for long-term investors. However, the Scandinavian and Swiss markets open up exciting opportunities for seasoned pros.

Whether you are a novice or an experienced investor, the tips revealed in this article will help demystify the stock market. With a dash of cunning and daring, you can start making money on the stock market.

Your Budget and Stock Market Goals

Before you embark on your stock market journey, it is crucial to determine the right amount to invest. Your cash reserves should be your guiding compass. Typically, seasoned investors avoid committing more than one-third of their cash savings to the stock market. For example, if you have $100,000 in savings, consider investing $33,000.

Time Management

You have to take into account the time you devote to your investments! To maintain a healthy perspective and prevent obsession, limit the frequency of portfolio checks to once a month. Excessive monitoring of stock markets just isn’t worth it. As long as you have made reliable investments, you just have to trust they will evolve positively over time.

Betting on Reliable Companies

Investing in dividend-paying companies is the best thing to do. This guarantees you’ll receive interest on your investments. In addition, by positioning yourself on stock purchases at competitive prices you will be able to increase the value of your portfolio in the medium term. Identifying resilient and sustainable companies is your ticket to weathering market downturns and emerging with a robust portfolio.

The stock market is a dynamic arena where individuals or groups of investors trade shares electronically. This trading takes place on a stock exchange, such as the New York Stock Exchange or Nasdaq for example.

Stock Market Indexes

When the media reports that “the market was up today,” they often refer to the performance of stock market indices like the Standard & Poor’s 500 and the Dow Jones Industrial Average.

The Standard & Poor’s 500 consists of 500 large publicly traded companies in the United States, while the Dow Jones includes the 30 largest companies on the New York Stock Exchange. These indices track the performance of collections of stocks.

In European markets, investing in stock indexes can be a lucrative alternative. These investments have the advantage of generating dividends and offer opportunities when global stock markets go through downward movements. Typically, the stock market indices of Spain, France and Italy often experience market fluctuations. Investors can make big profits when reselling their investments in only a year by entering these markets at the right time.

Please note: Stock indices do not represent all markets. The actual market includes thousands of publicly traded companies.

Resist Listening to Traders

You’ve no doubt heard about traders generating huge profits on the stock market. Also, if you have money in the bank, advisors may have already asked you to make juicy investments. Honestly, it’s better to ignore professionals in the field who tout miracle formulas.

The mission of any financial advisor is to help you invest your money according to the banks’ interests, not yours. Typically, an advisor who manages to encourage many clients to invest in the stock market is very well compensated. For each transaction made on your bank account, the bank collects fees. So, whether you win or lose, the bank will always win.

To retain control over your investments, consider becoming your own trader. With an online banking account tailored for stock investments

Minimizing Fees and Transactions

A successful stock market strategy involves minimizing the number of transactions and maintaining a long-term approach. This not only helps you maintain control over your portfolio but also reduces transaction fees. Relying on a bank advisor typically results in fees of at least 1% of your portfolio’s value, annually. Managing your own stock transactions can save you significant money overall.

Foreign Currency Investments

Foreign currency investments can be costly! Typically, if you are in the USA, your account will be in US dollars by default. If you want to invest in euros, or any other currency, your bank account will need to be multi-currency, and will incur monthly fees. In addition, when you convert dollars into foreign currency, the banks take a margin.

If you prefer, you can opt to trade in a single currency, such as the US dollar, which still offers attractive opportunities. For those looking to venture into foreign currency markets, experience and careful planning are essential.

Harnessing the Power of Dividends

Dividends are a portion of the profits that a stock market company pays to shareholders. It’s a way of rewarding stockholders. For investors looking for regular income, dividends are an unmissable opportunity. In addition, when the markets are good, there are great deals available when reselling your shares.

As long as your portfolio includes trusted brands, you may also benefit from stock value appreciation. If you have targeted companies that pay dividends, you will generate extra profits between the purchase and sales of your stocks.

Analyzing Stocks and Dividends

Before you go public, in-depth research is essential. Not all dividend paying companies are equal, and some can experience significant fluctuations.

The best way to measure the reliability of a company on the stock exchange is to scrutinize their stock value history over five years and its dividend payouts.

By selecting companies with stable stock market performances and attractive dividends, you can create a portfolio of reliable stocks.

Strategies for Winning Big with Dividends

The best way to get started on stocks that pay dividends is to select companies known for rewarding shareholders. This doesn’t mean that you should choose the companies that pay the highest dividends. In fact, the most profitable stocks often experience sudden stock market fluctuations.

Stocks paying dividends in the range of 1% to 5% can be solid choices. Naturally, buying the shares at the right price leads to the best deals. You could even double your share’s value if companies increase dividends over time. This approach can lead to significant portfolio growth.

Monitor Stock Market Movements

Staying informed about stock market developments is vital. Monthly check-ins should suffice to keep you abreast of the markets’ overall health. If your investments are in robust companies, there’s no need for constant worry.

Below, we’ve selected five reliable companies listed on the stock exchange that are known for paying dividends. If you look at the stock movements of these companies, you’ll be able to notice their cycles. So, you will ultimately get a good deal by investing in these companies when the market is down.

1. DANONE

A multinational food company listed on Euronext in Paris, Danone is part of the CAC 40 stock index. It offers decent dividends, making it a potential source of annual income.

Visit the DANONE site

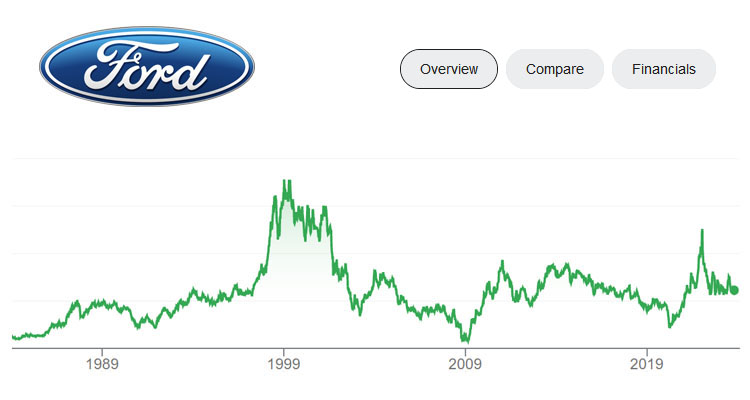

2. FORD

The American automotive giant, Ford, is a dependable feature in the industry. Investing when stock values dip can lead to substantial gains over time, doubling your investment.

Visit the FORD site

3. MICROSOFT

This IT behemoth has shown consistent growth and pays dividends annually, making it a solid addition to your portfolio.

Visit the MICROSOFT site

4. STARBUCKS

With robust profit margins, Starbucks is a promising investment. These types of stocks are worth buying and holding until they appreciate in value.

Visit the STARBUCKS site

5. BANK OF AMERICA

Strong banks often pay attractive dividends. When the stock market experiences fluctuations, consider investing in Bank of America for potential profits.

Visit the BANK OF AMERICA site

Diversify To Ensure Profits

Diversification is your shield against losses and you should never invest all your capital in just a few companies. It’s wise to distribute your investments across at least ten different options, focusing on stable and sustainable companies. Avoid putting your money into struggling enterprises, as this can eat away at your gains.

Recommended Profitable Sectors

Publicly traded companies with the best earning potential include the following sectors:

- Banks,

- Insurance,

- Aeronautical and automobile industries,

- Energy,

- Food industry,

- Pharmaceuticals,

- Luxury and watchmaking sector.

By choosing the most reliable companies within these sectors, you can minimize risk while ensuring regular dividend payments.

When to Buy Shares

Getting started with your first stock market investments can be stressful. But don’t panic! Every day, millions of investors carry out stock market transactions from their online banking accounts around the world. They are either buying, selling, or simply viewing the overall value of their holdings.

What is the most effective trick for success in the stock market? A simple yet effective strategy for stock market success is to buy shares during sharp global market declines. These opportunities arise frequently, and investors who capitalize on them often reap significant rewards. Savvy investors understand the power of patience. In addition, you often receive dividends during the time between purchases and sales.

Taking the case of a stock sensitive to stock market fluctuations, like FORD for example, drops of 10 to 30% are common. Investing in stocks like Ford when their values dip below $10 can lead to substantial profits.

Actions to Avoid

To avoid losing large sums of money on the stock market, never invest in a company when you don’t know their history. Investing in major brands or long-lasting companies is the path to follow.

Also, avoid investing in companies that don’t pay dividends. Often giants of the US stock markets, companies like GOOGLE, META and TESLA, never pay dividends. It’s essentially like you’re just giving free money to companies that generate huge profits.

Avoid Speculation

Novices often think that good deals are made by taking a risk on the stock market. However, buying and selling stocks often isn’t where the best deals are made. Keep your emotions in check and approach stock market investments with a level head to prevent impulsive decisions that can lead to financial setbacks. Getting caught up in the stock market madness can quickly lead to heavy financial losses.

Key Takeaways for Stock Market Success

- Do some research

Conduct thorough research to stay informed about market conditions. When the markets have been rising for several months in a row, it may be worth selling your shares. Conversely, if the markets have fallen significantly, now is the time to invest. - Prioritize quality

When you buy stocks, you are investing your money. Prioritize quality by investing in solid and reputable companies. Even if one of your investments has fallen sharply, as long as the company is strong, sooner or later the stock values will rise again. - Diversify your portfolio

As the saying goes, never put all your eggs in one basket. Diversify your portfolio to mitigate risk and secure returns. - Declare your stock market income

Gains made on purchases and sales of shares are taxable, and the same applies to any dividends. Ensure you declare your stock market income for tax purposes. - Generate income with dividends and sales of your shares

Dividends are only part of the equation of generating income. When you sell your shares, you will also be able to grow your capital.

Last Updated on January 19, 2024